In the current economic and social climate, the concept of company success goes well beyond simple financial profit. Companies are being increasingly assessed based on their impact on the environment and society and on the quality of their governance. This holistic approach is encompassed within the acronym ESG, a term that has become central to corporate strategies and investment decisions.

ESG means: environmental, social and governance

The acronym ESG has a simple but powerful meaning:

- E – Environmental: relates to the impact a company has on the natural world. It includes aspects such as greenhouse gas emissions, waste management, energy efficiency, use of natural resources, biodiversity and water management. A company with a good “E” profile undertakes to minimise its own environmental footprint.

- S – Social: this refers to the way in which the company manages relations with its employees, suppliers, customers and the communities in which it operates. Key elements are working conditions and rights of workers, diversity and inclusion, health and safety, protection of personal data, relations with suppliers and the impact on the local community. A strong “S” profile indicates a commitment to social responsibility.

- G – Governance: this concerns company leadership, its management, internal audits and the rights of shareholders. It includes topics such as transparent management, company ethics, the composition of the governing body (independence and diversity), remuneration of executive managers, the fight against corruption and fiscal policies. A good “G” profile ensures solid and responsible management of the company.

These three pillars form the ESG criteria, a framework of reference for measuring sustainability and the ethical impact of an investment or a company.

The growing importance of ESG criteria

The attention focused on ESG criteria has increased exponentially over recent years, as a result of various factors:

- Pressure from investors: an increasing number of investment funds and large financial institutions are adopting sustainable investment strategies, preferring companies with a strong ESG performance.

- Regulations: governments and international organisations are introducing stricter regulations on company sustainability and transparency.

- Consumer sensitivity: Consumers are becoming increasingly aware of these issues and are choosing the products and services of companies who demonstrate a tangible commitment to sustainability.

- Management of risk: companies with a poor ESG performance are perceived as being riskier, in terms of both reputation and regulatory compliance.

- Adopting an ESG strategy does not simply mean meeting expectations, but also creating long-term value, improving company resilience and attractiveness on the market.

From the sustainability report to ESG certification

Companies report on their ESG performance by preparing a document known as the sustainability report. This document is not just an obligation for certain large enterprises, but a strategic tool for reporting on the company’s path towards sustainability, outlining objectives, actions taken and results obtained in environmental, social and governance terms.

In addition to reporting, companies can also seek to obtain ESG certification. This certification is issued by independent agencies and certifies the sustainability performance of a company, providing objective proof of its commitment and distinguishing it on the market. Obtaining ESG certification is a strong sign for stakeholders, investors and customers and confirms the earnestness of the company’s approach.

WorkAir: an ESG bonus in the corporate responsibility report

Within the ESG criteria, the “Social” (S) aspect has a fundamental role, specifically including workers’ health and safety. A company which actively invests in the protection and well-being of its employees demonstrates a strong social commitment.

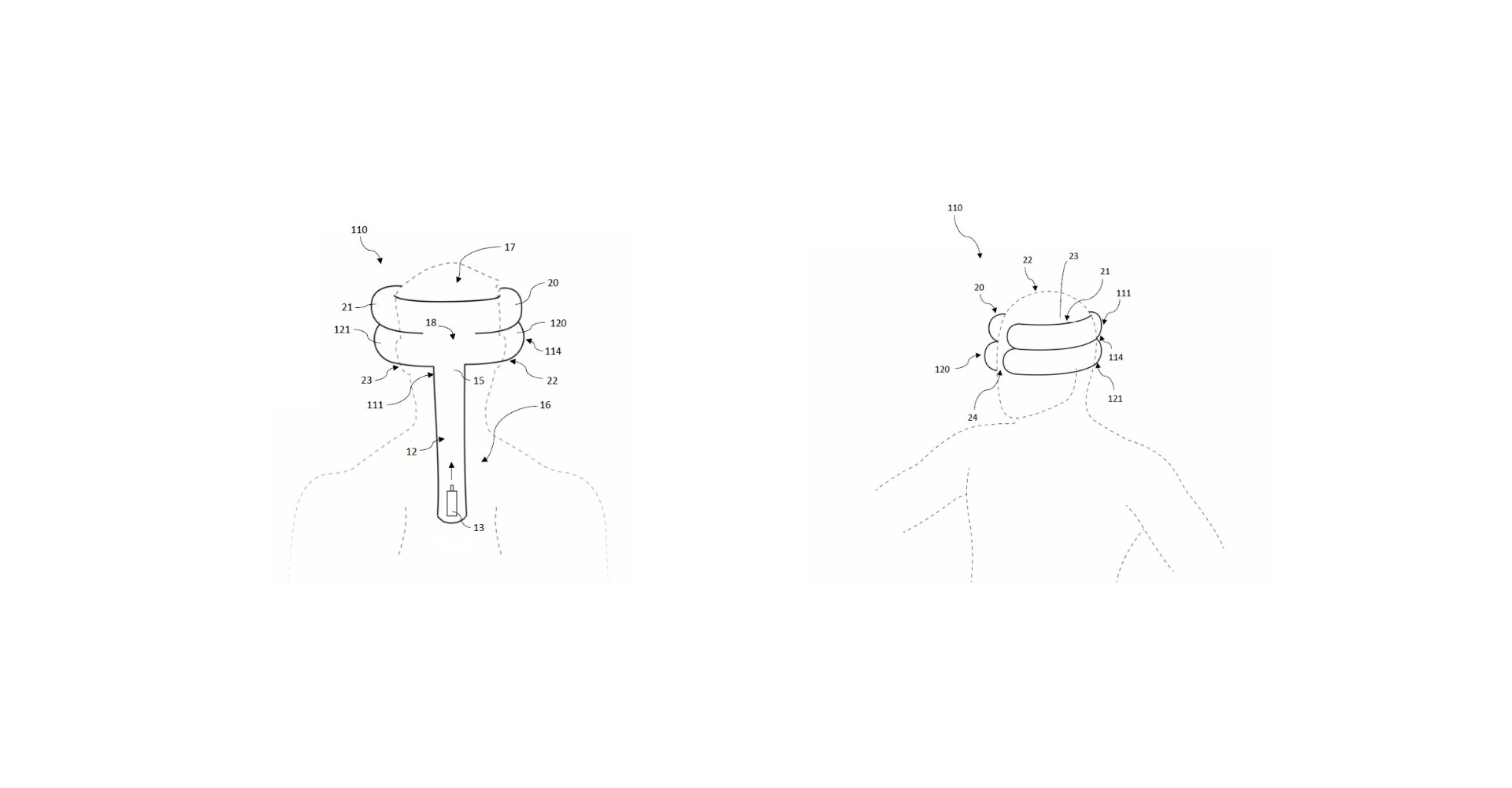

It is here that an innovative product such as WorkAir, the airbag for working off the ground, can make a difference and “bestow” a significant ESG bonus in the corporate responsibility report of companies who use it. WorkAir is PPE for workers who work off the ground, an airbag that inflates instantaneously in the event of a fall and drastically reduces the impact forces on the body and therefore the seriousness of the injuries. This feature makes it particularly valuable in complex situations: for example, when working off the ground at a height of around 2 metres, where the harness is mandatory but there are no fixed anchoring points for structural or logistical reasons, WorkAir bridges a gap in safety, acting as an independent protective shield.

Choosing WorkAir as additional PPE for workers is not just an action ensuring compliance with regulations and a positive impact on the ESG criteria, but a proactive investment in their safety and well-being. This translates directly into:

- Improvement of the “S” indicator: it demonstrates an exceptional focus on health and safety (“occupational health and safety” item in the social criteria). Reducing the seriousness of injuries has a direct impact on employees’ well-being and on the company’s reputation.

- Reduction of operating risks: fewer injuries means fewer interruptions in production, lower costs linked to accidents and absences, and a more stable and productive workplace, aspects that also fall within the Governance aspect.

- Attractiveness for new talent: companies who invest in advanced safety are perceived as more responsible and attractive employers, which makes it easier to acquire and keep new talent.

- Positive impact on the sustainability report: adoption of innovative technologies for safety can be highlighted in the sustainability report, strengthening the company’s overall ESG profile and its social responsibility reporting.

Conclusion

The ESG criteria are not just a passing trend, but the future of responsible and sustainable business. Understanding their meaning and integrating them into company strategy is fundamental to the creation of long-term value. Every action counts, from drafting of a sustainability report to obtaining of ESG certification. Investing in state-of-the-art solutions for workers’ safety, such as WorkAir, not only protects people, but also improves the company’s ESG profile, demonstrating a tangible commitment to a more sustainable and responsible future for everyone.

Contact us to obtain more information on WorkAir and how it can help you in improving the health and safety of your workers!